Charting Your Course

Change can be unsettling. As we experience transitions in our lives, they are times of uncertainty. This book offers women insight into being financially

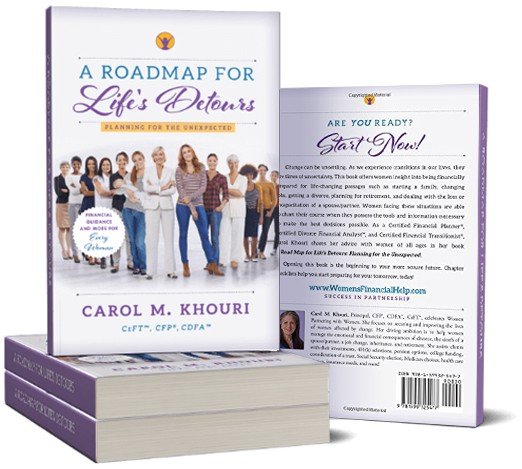

prepared for life-changing passages such as starting a family, changing jobs, getting a divorce, planning for retirement and dealing with the incapacitation or loss of a spouse/partner. Women facing these situations are able to chart their course when they possess the tools and information necessary to make the best decisions possible. As a Certified Financial Planner®, Certified Divorce Financial Analyst™ and Certified Financial Transitionist®, Carol Khouri shares her advice with women of all ages in her book A Road Map for Life’s Detours: Planning for the Unexpected.

Opening this book is the beginning to your more secure future. Chapter

checklists help you start preparing for your tomorrow, today!

Interested in having Carol speak to your group?

Not only does Carol provide individual consulting to each of her clients, she also gives presentations about

managing money to women of all ages. She is a speaker on planning for life's unexpected events.

Carol is often asked to run financial planning workshops for organizations and groups.

Carol's Expertise

Carol M. Khouri, Principal, CFP®, CDFA™, CeFT® focuses on

securing and improving the lives of women.

Carol assists clients with their goals and dreams that often involve considerable financial decisions. She assists with investment matters, 401k selections,

buying/selling a home, tax savings strategies, retirement timing, trust considerations,

social security election, Medicare choices, pension options, long-term care planning, and debt matters.